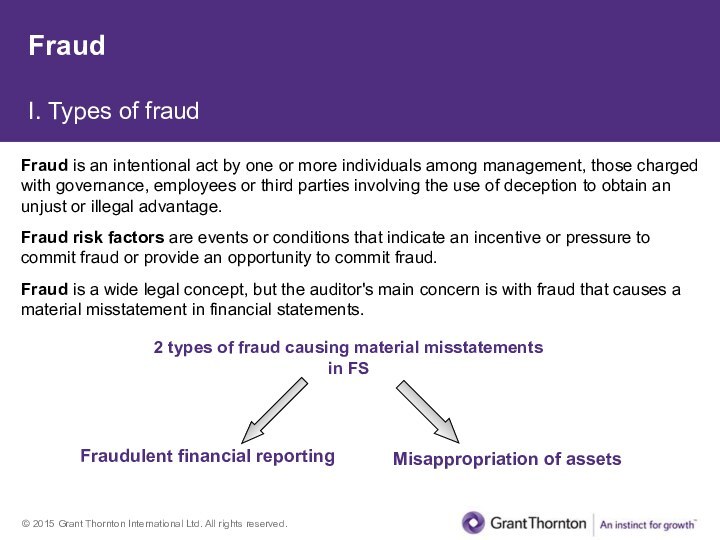

by one or more individuals among management, those charged

with governance, employees or third parties involving the use of deception to obtain an unjust or illegal advantage.Fraud risk factors are events or conditions that indicate an incentive or pressure to commit fraud or provide an opportunity to commit fraud.

Fraud is a wide legal concept, but the auditor's main concern is with fraud that causes a material misstatement in financial statements.

2 types of fraud causing material misstatements in FS

Fraudulent financial reporting

Misappropriation of assets