for his work on portfolio theory and asset pricing,

both theoretical and empirical.Currently he is a professor of finance at the University of Chicago Booth School of Business. MBA, PhD.

FindSlide.org - это сайт презентаций, докладов, шаблонов в формате PowerPoint.

Email: Нажмите что бы посмотреть

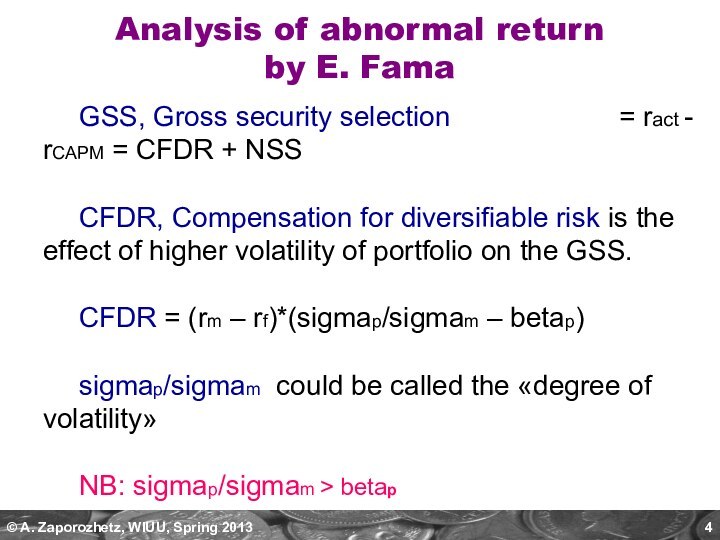

Analysis of abnormal return

by E. Fama

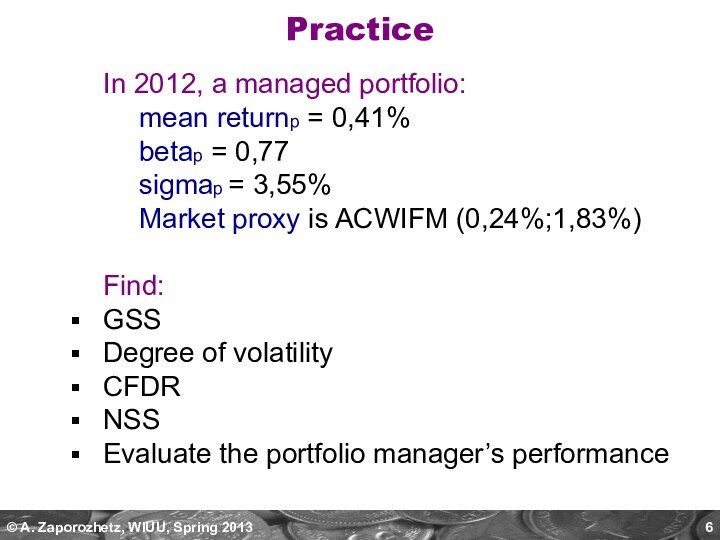

Practice