Слайд 2

Agenda

0840 Introducing RSM Terry McAdam

Robust project selection Terry McAdam

0910 Financial project appraisal Julian

Caplin

0940 Selecting the right project Derek Young

1015 Coffee

1030 Group case study exercise Terry McAdam

1130 Tax

planning opportunities re R&D Julian Caplin

1145 CFO forum Tom Early

1230 Lunch

Слайд 3

SPEAKERS

Serial inventor and entrepreneur

Derek Young CEO of

i360medical

Highly accomplished and respected financial expert.

Julian Caplin Partner

Performance

improvement expertise – technology strategy and deployment allied to process automation

Terry McAdam Partner

Слайд 4

Every RSM firm,

wherever they are in the

world, shares the same high standard of quality

37,500 MINDS,

730 OFFICES, 110 COUNTRIES, 1 NETWORK.

Слайд 5

RSM IRELAND

About us

Formerly Baker Tilly Ryan Glennon

An Irish

Top 10 firm of accountants and business advisors (no.

8)

Specialist in the mid-market

Mid-market client base – Domestic & International

13 Partners

Specialist & sector led

One of the fastest growing Irish mid-tier firms - 130 staff

Offices in Dublin, Birr and Portlaoise

Слайд 7

RSM IRELAND

Terry McAdam

Management Consulting Partner

Terry leads a team

of experienced performance improvement consultants

Deliver operational improvement which yields

tangible results

Investment in technology and process automation/enhancement

Over twenty years experience

Guided organisations, of varying scale, through the successful design and execution of complex projects or work programmes

Delivering projects nationally and internationally on an ongoing basis

Слайд 8

EVERY RSM FIRM,

WHEREVER THEY ARE IN THE

WORLD, SHARES THE SAME HIGH STANDARD

OF QUALITY

Слайд 9

SELECTING YOUR PROJECT

Terry McAdam

Слайд 10

SELECTING YOUR PROJECT

Contents

Rationalisation of existing projects/initiatives

The business case

Resourcing

the project

Project governance

Continuous improvement

Слайд 11

RATIONALISATION OF EXISTING PROJECTS/INITIATIVES

Слайд 12

SELECTING YOUR PROJECT (cont.)

Rationalisation of existing projects/initiatives

Prior to

launching a new project, prudent to review existing project

portfolio and its performance.

Project gateway approach ensures investments and projects are consistently reviewed to verify they are delivering expected outcomes

Ensure planned/on-going projects and investments remain aligned with the strategic goals of the business

Introduces decision points across life of a project where business can “get off the project bus”

Consistently non-performing projects are continuously monitored and brought to a controlled end early in their life

Слайд 14

SELECTING YOUR PROJECT (cont.)

Stage Gate Review - Process

Overview

It is an independent confirmation by the Stage Gate

Review Team to the governance body that all required project reviews have been successfully conducted

The team ensures that the project manager has produced all the required deliverables and addressed all exit criteria for a given phase to permit the project’s advancement to the subsequent phase

Слайд 15

SELECTING YOUR PROJECT (cont.)

Stage Gate Review - Process

Overview

The emphasis of the Stage Gate Review is on

the:

successful accomplishment of phase objectives

plans for the next life cycle phase and

risks associated with moving into the next life cycle phase.

Recommended actions arising from the review are issued to the governance body.

Слайд 16

SELECTING YOUR PROJECT (cont.)

Building Blocks

Outputs from the review

include a decision (i.e. approved, conditionally approved, or not

approved) and a clear path forward

Слайд 17

Phase-driven go/no-go decision points are identified across the

life of the project where activity is reviewed to

provide assurance that appropriate organisational and strategic objectives continue to be observed and achieved.

SELECTING YOUR PROJECT (cont.)

Decision Points

Слайд 18

SELECTING YOUR PROJECT (cont.)

Best Practice – Review Process

Clearly

defined roles and responsibilities:

define roles and responsibilities so

that all project participants are clear with regard to expectations and the overall process

Stage Gate Review preparation:

Prior to attending a Stage Gate Review meeting, all in attendance must have reviewed all pertinent documentation and have a good understanding of the project and its performance, the organisational context in which it is operating and the exit criteria for the relevant stage gate

Слайд 19

SELECTING YOUR PROJECT (cont.)

Best Practice - Review Process

Clear

and concise decision comes from the governance body or

delegated authority:

Stage Gate Review outputs must be clearly documented and communicated;

Outputs include a decision (i.e. approved, conditionally approved, or not approved) and a clear path forward; and,

A plan of action and milestones for corrective action, if required, should be defined along with a clear understanding of the oversight process that will be applied to support the implementation of the additional controls sought

Слайд 21

SELECTING YOUR PROJECT (cont.)

The Business Case

Why do the

project? What is the payback period?

Слайд 22

SELECTING YOUR PROJECT (cont.)

The Business Case (cont.)

Requires business

to consider proposed project in some depth. Aids buy-in

of key management and people

Assumptions re potential impact of project are critical

Consider financial and non-financial benefits (risk mitigation, better communication, enhanced quality)

Beware of drive for false precision within projects causing paralysis/delay

Слайд 24

SELECTING YOUR PROJECT (cont.)

Resourcing the project

If project worth

doing then must allocate your best people

Consider all

your options to ensure ‘Business as Usual’ not impacted

Temporary external resources can be allocated to some project roles but proceed with care

Monitor and anticipate project resourcing issues continuously. Ad hoc resourcing decisions can prove expensive.

Слайд 25

SELECTING YOUR PROJECT (cont.)

Resourcing the project (cont.)

Слайд 27

SELECTING YOUR PROJECT (cont.)

Project governance

Project sponsor

Project steering group

Project

manager

Project team (including subject matter experts)

Checkpoint/Steering group meetings

Checkpoint/final reporting

Escalation

procedures/reporting lines

Stage gate reviews

Слайд 28

SELECTING YOUR PROJECT (cont.)

Define project scope, key roles,

responsibilities and reporting structures in a Project Initiation Document

(PID)

Слайд 29

SELECTING YOUR PROJECT (cont.)

Project governance (cont.)

Seek to embed

a culture, across the business, that allows project managers

to declare issues early

Forward looking reporting details the expected activity (and risks) over the upcoming period

Provides a summary of the latest expected outturn – financial and operational

Report formats are defined and not negotiable, once agreed

Project reporting sources are consistent with the finance function reporting

One page narrative accompanies every project financial report template

Слайд 31

CONTINUOUS IMPROVEMENT

Identifying and agreeing processes which provide the

basis for continuous improvement

developing a set of relevant key

performance indicators will drive the required behaviours over the longer term

continuous improvement is an on-going internal, and often multi-disciplinary, effort seeking incremental performance improvement over time

sustained focus on waste eradication and quality

Слайд 33

FINAL THOUGHTS

We are all constantly undertaking projects.

Need to

create environment which gives project best chance

Projects are

resource hungry. Internal costs are often significant

Identifying key processes and datasets is the best starting point to de-risk projects

Underperforming projects are identified early and brought to an organised end

Слайд 34

FINAL THOUGHTS

The approach to delivering projects in a

business should be standardised and repeatable

Consider a Project Management

Office (PMO) model if need to manage multiple projects centrally

Progress at the pace which is right for the business. Controlled, organised and profitable change is the goal

Слайд 35

FINANCING YOUR PROJECT

Julian Caplin

Слайд 36

RSM IRELAND

Julian Caplin

Consulting Partner

Leading financial advisor, providing corporate

finance, business, commercial and financial advice to a wide

range of businesses.

Financial advisory services – MNA, funding structures, strategic financial advise and financial diligence.

Former Director of The Pensions Board (Irish Pension Regulator) and has been involved in arbitration strategies at state level.

Слайд 37

PROJECT APPRAISAL

Overview

Project’s viability

Financial appraisal

Use of financial assumptions

Multiple issues

outside financial appraisal

Consider all aspects in project appraisal

Слайд 39

IDEATION STAGE

Sourcing ideas…

Personal experience

Career development

Universities

Innovation hubs

Слайд 41

EARLY STAGE RESOURCES

Reliance on friends and family

Angel investors

Support

from industry, i.e. research foundations, universities, etc.

Government incentives, e.g.

EI, IDA, etc.

Venture funds from larger corporates

Слайд 43

PROJECT APPRAISAL

Early Stage

Less sophisticated methods

Emotion led

Projections highly speculative

Point

of return on investment less defined

Investor fatigue

Слайд 44

PROJECT APPRAISAL (cont.)

LATE STAGE

Projections more sophisticated and reduced

speculation

Key ratios:

- Debt ratio

- Liquidity ratio

- Profitability

- Cash flow

Formal valuation methods, including

- Discounted

cash flow

- Net present value (NPV)

- Internal rate of return (IRR)

- Payback period

- Scenario analysis

Слайд 45

PROJECT APPRAISAL (cont.)

INVESTOR CONSIDERATIONS

Economic environment.

Risk levels associated with

R&D

Prototype

Proven track record - Pre-sales / feasibility studies

Tax Incentives

Слайд 47

FUNDING R&D PROJECTS

Funding Agencies

Often government department or agencies

Criteria

based, often employment driven, innovation, environment, etc.

Start-up company criteria

may differ – particular funds

Examples include, Enterprise Ireland, the Department of Jobs, Enterprise & Innovation

Benefits include expertise, not seeking pre-determined return on investment, access to information and expertise particularly if doing business abroad

Can be restrictive in terms of criteria, predicated on other events e.g. level of equity from other investors, employment prospects, etc.

Слайд 48

FUNDING R&D PROJECTS (cont.)

Venture Capital and Private Equity

Private

funding and government led initiatives

Criteria based and can include,

sector, location, deal size, stage of development

Willing to lend where banks will not, rates relevant to risk

Examples include, Kernal Capital, BlueBay Asset Management, ESB Novusmodus

Benefits include external knowledge, exhausted more conventional financing, sectoral expertise can open new markets and opportunities and potential access to further funding

Can be expensive, early definition of exit strategy, perceived interference in company

Слайд 49

FUNDING R&D PROJECTS (cont.)

Private Investors

Looking at investment opportunities

Can

bring expertise to company through board representation

Often willing to

grow with the company

Benefits from not being a corporate which can bring flexibility, varying degrees of involvement depending on agreements and potential access to further funding

Can lead to issues of money versus invention, involvement in the business can seep, lack of corporate type access to markets / knowledge

Слайд 51

RSM IRELAND

Derek Young

CEO, i360medical

Derek is a inventor

and entrepreneur with a background in Mechanical Engineering, Surgical

Innovation and Business Development from the Austin Waldron and Dublin Institute of Technology.

Specialties

Development of Business Strategy for small to medium companies.

Raising investment through Venture capitalist and Government Grants for start-ups and Projects.

Acquisitions for existing company.

Excellent interactive and interpersonal skills both in terms of staff motivation and teamwork involvement, customer communication and service. Liaising successfully with internal/external Surgeons, customers, consultancies, and contractors thus facilitating teamwork and partnerships.

Слайд 52

i360medical

A Healthcare Innovation Company

2015

“To generate and commercialise

new world-class medical technology

solutions, in pursuit of enhanced

patient care”

Please Contact Derek Young

Tel:+353 (0)86 8281551 IRL Dublin Office

Tel: +1 516 491 5163 USA New York Office

Email: derekyoung@i360medical.com

Слайд 53

i360medical Ideation, Development & Commercialisation Ecosystem

i360medical In-House

Healthcare Ideation

Clinician

Inventor ideas

Healthcare Professional ideas

Academic Inventor ideas

Engineering Inventor ideas

i360 Multistage

Process

Activities include:

Innovation eco system development

Ideation & & Sourcing

International Clinical insights

Ideation & Concept validation

IP Development

Final Device design & development

HIT software development

CE & FDA trials & regulatory approval & reimbursement to commercialisation

Investment Partners

$/€ Externally Managed

aligned Commercial fund. Comprising Private & Institutional Investors.

Healthcare System Partners for Ideation & Qualification to Start-Up

_____________________

Irish private Health

Health HSE

Industry Partners

i360medical maintain relations at ‘C Suite’ level with 11 acquisitive Healthcare MNCs interested in sourcing novel licensing, product and start-up acquisition opportunities.

IP, License, Acquisition Opportunities, Novel Products, SPV/Start-Ups

SJH

1

Слайд 54

i360medical Board of Directors

Derek Young Irl

Prof. Oscar Traynor

Irl

Eamonn Fitzgerald Irl

Hermitage Clinic

Fergus Clancy Irl

Mater Hosp Private

Prof. Paul

Neary Irl

Dr Sean Lyden US

Cleveland Clinic

Dr. Richard Stack US

Bill Starling US

i360medical Board

Слайд 55

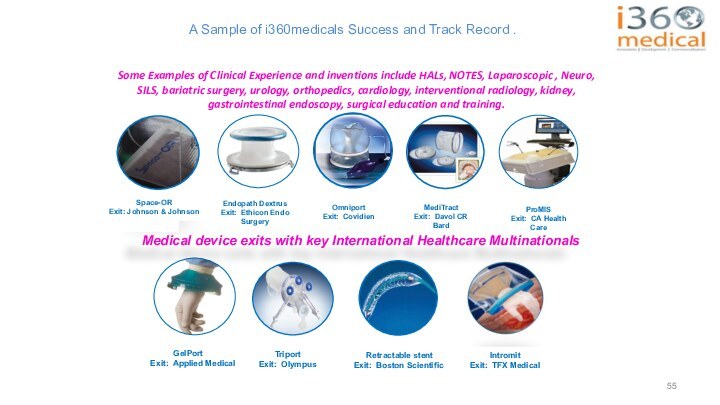

Some Examples of Clinical Experience and inventions include

HALs, NOTES, Laparoscopic , Neuro, SILS, bariatric surgery, urology,

orthopedics, cardiology, interventional radiology, kidney, gastrointestinal endoscopy, surgical education and training.

Endopath Dextrus

Exit: Ethicon Endo Surgery

Omniport

Exit: Covidien

MediTract

Exit: Davol CR Bard

GelPort

Exit: Applied Medical

Intromit

Exit: TFX Medical

Retractable stent

Exit: Boston Scientific

Triport

Exit: Olympus

Medical device exits with key International Healthcare Multinationals

ProMIS

Exit: CA Health Care

Space-OR

Exit: Johnson & Johnson

xxxxx

A Sample of i360medicals Success and Track Record .

Ideation Phases Commercialisation Phases

↓ Ideation Partner Finances ↓ Internal & External Grants ↓ Commercial Funding ↓

Why i360medical?

Our practical experience & expertise and track record. Our global clinical & industry network. We form a ‘bridge for new ideas’.

Benefits of our approach

Accelerates validated ideas & concepts. “Fail quickly” where appropriate.

Independent & Global, objective & detailed analysis. Detailed & practical development roadmaps.

An innovation ecosystem to optimise ROI. A ‘turn key’ for accelerated device commercialization.

Eco system & Identification of new ideas

Assessment of Ideas

Generation of clinical & Commercial opinions globally

Assessment product pipelines / portfolio

Idea categorisation & prioritisation

Brainstorming

Idea selection

Initial Design

Proof of Concept

Clinical, Technical and Market Assessment (CTM)

Initial IP

Design and Prototyping verification

Develop CE & FDA Plan

GLP Wet Labs Trials

Design Freeze

Design to manufacture product

Validation of the Design/product

Development and scale Manufacturing

First-in-Man trial

Initiate CE and FDA plan

Reimbursement plan

Full Multisite Clinical Trial (with partner)

CE & FDA approval

Pre-sell to industry, exit/partner licensee.

Spin Outs, Joint Ventures

Healthcare Innovation Partnership

Formalised Medical Device ‘Idea to Commercialization Process

IDEATION RETAINER+

PROJECT START SPV

PROJECT MID TERM SPV

PROJECT SPV @ FIM

SPV to START UP

START UP

Слайд 57

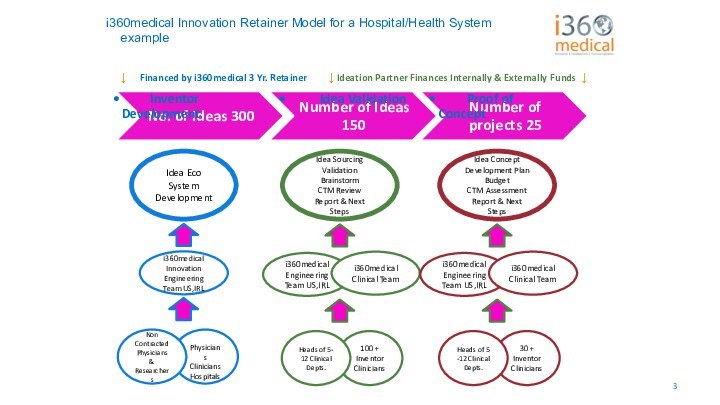

i360medical Innovation Retainer Model for a Hospital/Health

System example

Idea Eco System Development

i360medical

Innovation Engineering Team

US,IRL

Physicians

Clinicians Hospitals

Non Contracted Physicians

& Researchers

Idea Sourcing

Validation

Brainstorm

CTM Review Report & Next Steps

i360medical

Engineering Team US,IRL

i360medical Clinical Team

100 + Inventor Clinicians

Heads of 5- 12 Clinical Depts.

Idea Concept

Development Plan

Budget

CTM Assessment Report & Next Steps

i360medical

Engineering Team US,IRL

i360medical Clinical Team

30 + Inventor Clinicians

Heads of 5 -12 Clinical Depts.

↓ Ideation Partner Finances Internally & Externally Funds ↓

↓ Financed by i360medical 3 Yr. Retainer

3

Слайд 58

A Bridge between Clinical and Commercial World

:

Inventive Physician Cohort

Bridges and Connects

Potential Acquirers of your Ideas

Identify Project Funding

Hospital/Health System

Research/OTT/

Innovation Centre

Слайд 59

Example output from one of i360medicals US Outreach

Innovation Programs

Since inception of the program, this Outreach Innovation

program has with in 18 months

Established internal ecosystem for:

Disclosing circa 150 ideas and innovations

Engineering support for ideation

Evaluating value proposition

Underwriting intellectual property

Funding translational activities

Three projects prioritized in 2015

Cardiology, General Surgery & Urology

Secured pre-seed project funding for advancing:

Prototypes and validation

Provisional patent filings

Development for Commercial Seed funding

Identified three new Projects in 2016

Innovations % by Speciality

Слайд 60

Clinical Leads

EU

USA

Middle East

Australasia

Each Clinical speciality, Clinical

Leads manage i360medical Clinical Opinion and Idea Providers from

EU,USA, Middle East and Australasia.

Our Clinical Leads and Opinion Providers

Слайд 61

Clinical Technical & Market Focus

10

Слайд 62

Ideation, IP and Projects; Global Eco System

CCI

Start Ups

Feinstein Institute

Cincinnati Children's Health

Irish Healthcare System

Ideation

Academia & Engineers

Irish

Private & Public Hospitals

DOH & HSE

OTT

Children's

ROW Government Agencies

US Gov & State Agencies

Influential Board of Directors

Finance & Investment Partners

FDA Approval

CE Mark

Multinationals

Healthcare Medical Devices

Global Healthcare Systems

Слайд 63

Innovation; Strategic Structure

Australasian Healthcare Systems

Irish Healthcare

System

Finance & Investment Partners

FDA Approval

CE Mark

US

Gov &

State Agencies

Influential Board of Directors

Australasian Agencies

EU Agencies

Слайд 64

Thanks

Please Contact Derek Young

Tel:+353 (0)86 8281551 IRL

Tel:

+1 516 491 5163 USA

Email: derekyoung@i360medical.com

Слайд 66

PLANNING OPPORTUNITIES - INNOVATION INCENTIVES

Слайд 67

Planning Opportunities – Innovation Incentives

Research and Development Tax

Credit

Knowledge Development Box

IP Capital Allowances

Typical Structuring

Слайд 68

R&D Tax Credit Overview

€25 credit / cash refund

for every €100 spent

Utilisation

Offset against corporation tax liability in

the year in which the claim is made

Carry back and offset against corporation tax in prior year

Cash refund issued in 3 instalments over following 3 years

Refund Mechanism Limitations

Limited to CT paid during 10 previous accounting periods, or

Payroll taxes for period of claim and payroll taxes for preceding year (in certain circumstances)

Refund Mechanism Instalments

Year 1 – 33% of R&D tax credit during the period

Year 2 – 50% of remaining R&D credit carried forward

Year 3 – Remaining 50% of R&D credit carried forward

Слайд 69

R&D Tax Credit Overview

Qualifying Criteria

Systematic, investigative or experimental

activities

Within an approved field of science or technology

Being basic

research / applied research / experimental development

Involve the resolution of scientific or technological uncertainty

Seek to achieve scientific or technological advancement

Eligible Expenditure

Salary

Plant and machinery

Raw materials consumed as part of the R&D process

Subcontracted R&D

Power consumed as part of the R&D process

R&D Buildings

Revenue’s Interpretation of Qualifying Expenditure

Allowable Indirect Costs 2011 Guidelines v Allowable Indirect Costs 2015 Guidelines

Appointment of Expert in Revenue Audit Situation

Слайд 71

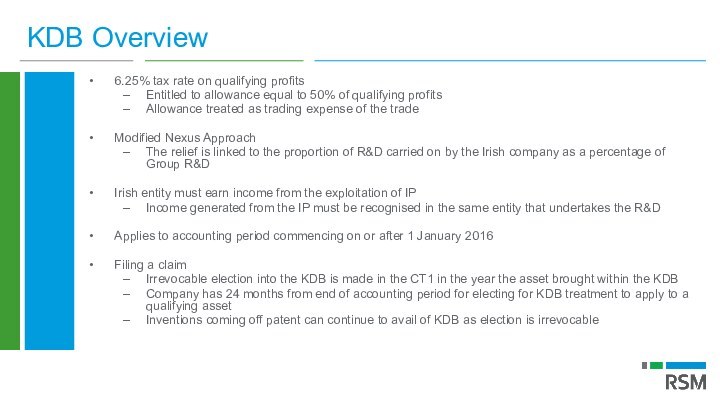

KDB Overview

6.25% tax rate on qualifying profits

Entitled to

allowance equal to 50% of qualifying profits

Allowance treated as

trading expense of the trade

Modified Nexus Approach

The relief is linked to the proportion of R&D carried on by the Irish company as a percentage of Group R&D

Irish entity must earn income from the exploitation of IP

Income generated from the IP must be recognised in the same entity that undertakes the R&D

Applies to accounting period commencing on or after 1 January 2016

Filing a claim

Irrevocable election into the KDB is made in the CT1 in the year the asset brought within the KDB

Company has 24 months from end of accounting period for electing for KDB treatment to apply to a qualifying asset

Inventions coming off patent can continue to avail of KDB as election is irrevocable

Слайд 72

KDB Overview

Main categories of IP covered by KDB

are:

Qualifying Patent / Supplementary protection certificated for medicinal products

/ Plant protection certificated / Plant breeder’s rights / Copyrighted Software

IP for SME’s

IP which is “patentable but not yet patented”

Certified as “novel, non-obvious and useful”

Irish Patent Office to make the certification

Documentary Evidence

Слайд 74

IP Capital Allowances Overview

C.A.’s for costs incurred in

acquiring “specified intangible assets” – 3rd party or related

party

Qualifying asserts include patents, registered designs, trademarks and names, brand names, domain names, copyrights, know-how, licenses etc. and any goodwill directly attributable to these assets

Acquired from a related party - amount qualifying for relief cannot exceed the market value of the asset

The relief is claimed under one of the following methods:

7% straight line for 14 years followed by 2% straight line in the 15th year

Depreciation/amortisation/impairment charge in the Statement of Comprehensive Income

Restriction on the amounts of allowance that can be offset

The capital allowances can only be offset against income from “relevant activities”

Unutilised capital allowances are carried forward for future offset against relevant trade income

Слайд 76

Split of TradeCo. and IPCo.

Parent

TradeCo.

3rd party customers

License of

IP

Contracts with 3rd Parties

IPCo.

Scenario

The IPCo. owns the rights to

the intellectual property.

R&D Employees and Outsourced R&D in IPCo.

The IPCo. licenses the use of the IP rights to the TradeCo. in return for an arm’s length fee.

The TradeCo. contracts directly with third party customers.

Irish Tax Outcome

IPCo. trading profits generally should be taxed at a rate of 6.25% (KDB) / 12.5% provided sufficient skilled workers and management of IP in IPCo.

IP is held in separate company from trading company should there be:

IP Sale only

Trade Sale only

Protects value of IP should there be litigation against TradeCo.

Potential S626B exemption on sale of IPCo if parent in Ireland.

If parent is resident outside of Ireland, any gain on a sale of IPCo is outside the scope of Irish taxation

R&D Employees

Outsourced R&D

Слайд 77

Split of TradeCo. and IPCo - Variation

Irish Tax

Outcome

Potential to significantly reduce the cost of conducting R&D

by outsourcing to related party in low cost jurisdiction

However, IPCo cannot avail of R&D tax credit on such outsourced expenditure

IreCo will be entitled to a tax deduction for cost of remunerating related party for undertaking R&D

Arm’s length rate must be agreed with related party

Compare costs of carrying out R&D in Ireland and availing of R&D Tax Credit v outsourcing R&D to related party and not availing of relief

Parent

TradeCo.

3rd party customers

License of IP

Contracts with 3rd Parties

IPCo.

R&D Employees

Outsourced R&D

Outsourced R&D (Related Party)