for the use of my money, but for the

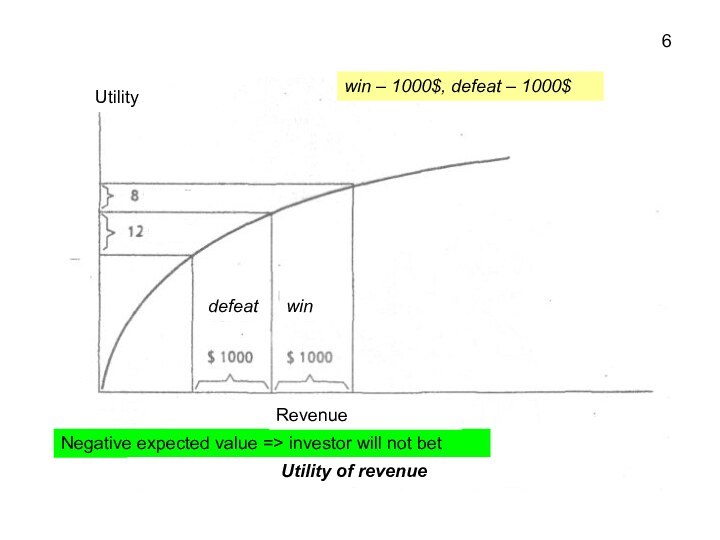

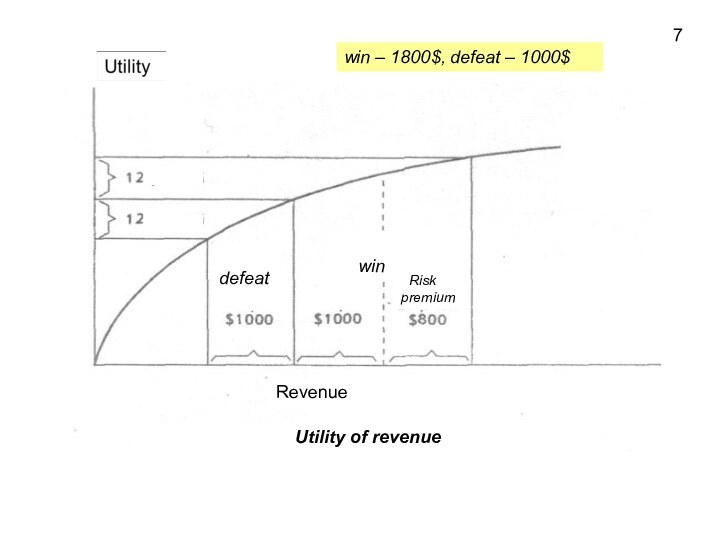

risk to remain without them!… a higher rate of profit, if there is a risk…

5

FindSlide.org - это сайт презентаций, докладов, шаблонов в формате PowerPoint.

Email: Нажмите что бы посмотреть

… a higher rate of profit, if there is a risk…

5

10

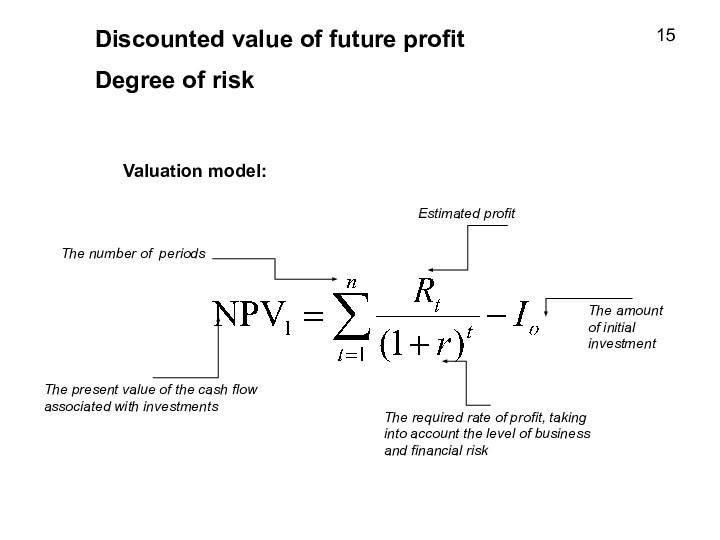

The required rate of profit, taking into account the level of business and financial risk

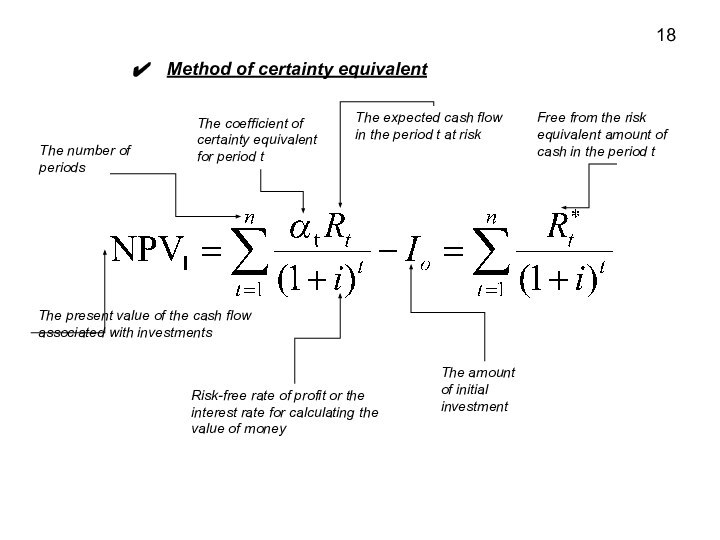

The number of periods

The amount of initial investment

15

17

Ех:

The expected cash flow in the period t at risk

Risk-free rate of profit or the interest rate for calculating the value of money

The number of periods

The amount of initial investment

Free from the risk equivalent amount of cash in the period t

18

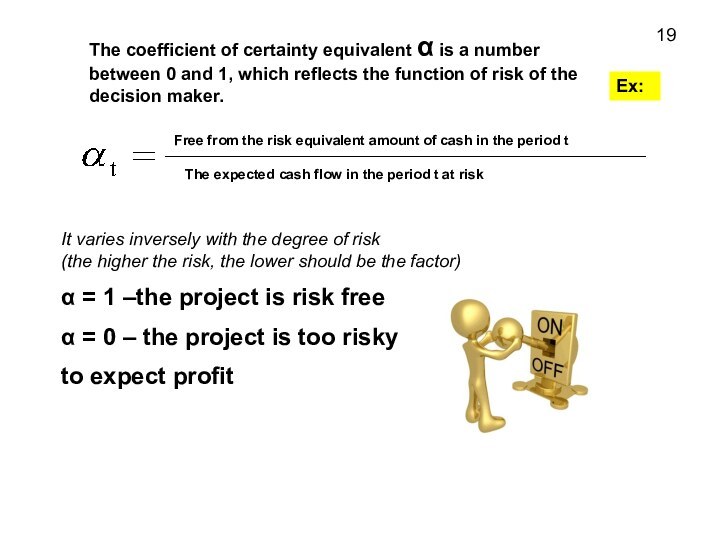

It varies inversely with the degree of risk

(the higher the risk, the lower should be the factor)

α = 1 –the project is risk free

α = 0 – the project is too risky

to expect profit

Free from the risk equivalent amount of cash in the period t

The expected cash flow in the period t at risk

19

Ех: