- Главная

- Разное

- Бизнес и предпринимательство

- Образование

- Развлечения

- Государство

- Спорт

- Графика

- Культурология

- Еда и кулинария

- Лингвистика

- Религиоведение

- Черчение

- Физкультура

- ИЗО

- Психология

- Социология

- Английский язык

- Астрономия

- Алгебра

- Биология

- География

- Геометрия

- Детские презентации

- Информатика

- История

- Литература

- Маркетинг

- Математика

- Медицина

- Менеджмент

- Музыка

- МХК

- Немецкий язык

- ОБЖ

- Обществознание

- Окружающий мир

- Педагогика

- Русский язык

- Технология

- Физика

- Философия

- Химия

- Шаблоны, картинки для презентаций

- Экология

- Экономика

- Юриспруденция

Что такое findslide.org?

FindSlide.org - это сайт презентаций, докладов, шаблонов в формате PowerPoint.

Обратная связь

Email: Нажмите что бы посмотреть

Презентация на тему Venture capital

Содержание

- 3. WIKI: What is venture capitalVenture capital (VC) is financial

- 4. VC: fantasies and expectationsQ: What rate of

- 5. Sad glimpse of realityhttp://www.avc.com/a_vc/2013/02/venture-capital-returns.html

- 6. How many projects succeed? 10 enhtusiasts3 dead3 living dead3 so-so1

- 7. Draper’s Rocket PipelineInvestment: 11 projectsDue Diligence110 projects1 100 meetings with project teams11 000 project summaries1 project

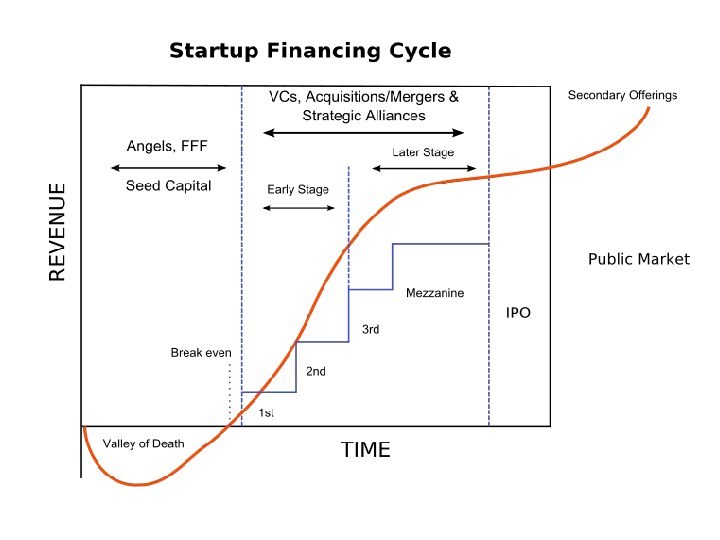

- 9. What is venture capital

- 10. WIKI: Venture roundVenture round is a type of funding

- 11. Parties in the playFinders or stockbrokers. Introduce companies

- 12. Stages in investmentIntroduction. Offering. Private placement memorandum.

- 13. Introduction Investors and companies seek each other

- 14. Offering and first informal agreementsOffering. The company

- 15. Formal thingsDefinitive transaction documents. A drawn-out (usually

- 16. More formal thingsInvestor rights agreements — covenants

- 17. Next stagesDue diligence. Simultaneously with negotiating the

- 18. The end …Closing occurs when the investors

- 19. Скачать презентацию

- 20. Похожие презентации

WIKI: What is venture capitalVenture capital (VC) is financial capital provided to early-stage, high-potential, high risk, growth startup companies. The venture capital fund makes money by owning equity in the companies it invests in, which usually have a novel technology or business model in high technology industries,

Слайд 4

VC: fantasies and expectations

Q: What rate of return

would a venture capitalist generally expect?

Answered by Phil Verity,

Mazars, 2007 The initial rate of return most VCs would expect is 25 per cent (annualised). A VC will be looking to achieve this - at least - and exit a business in four to five years.

Phil Verity is a partner at Mazars, the international accounting and business advisory firm, and head of the mid corporate market business line.

See more at: http://www.growthbusiness.co.uk/growing-a-business/venture-capital-and-private-equity/254447/qanda-a-vcs-expected-return.thtml#sthash.IC4YlYEU.dpuf

Слайд 7

Draper’s Rocket Pipeline

Investment: 11 projects

Due Diligence

110 projects

1 100

meetings with project teams

11 000 project summaries

1 project

Слайд 10

WIKI: Venture round

Venture round is a type of funding round used

for venture capital financing, by which startup companies obtain investment, generally from venture capitalistsand

other institutional investors. The availability of venture funding is among the primary stimuli for the development of new companies and technologies.

Слайд 11

Parties in the play

Finders or stockbrokers. Introduce companies to

investors.

A lead investor, typically the best known or most aggressive

venture capital firm that is participating in the investment, or the one contributing the largest amount of cash. The lead investor typically oversees most of the negotiation, legal work, due diligence, and other formalities of the investment. It may also introduce the company to other investors, generally in an informal unpaid capacity.Co-investors, other major investors who contribute alongside the lead investor

Follow-on or piggyback investors. Typically angel investors, rich individuals, institutions, and others who contribute money but take a passive role in the investment and company management

The company being funded

Law firms and accountants are typically retained by all parties to advise, negotiate, and document the transaction

Слайд 12

Stages in investment

Introduction.

Offering.

Private placement memorandum.

Negotiation

of terms.

Signed term sheet.

Definitive transaction documents.

Definitive

documentsDue diligence.

Final agreement

Closing

Post-closing.

Слайд 13

Introduction

Investors and companies seek each other out

through formal and informal business networks, personal connections, paid

or unpaid finders, researchers and advisers, and the like. Because there are no public exchanges listing their securities, private companies meet venture capital firms and other private equity investors in several ways, including warm referrals from the investors' trusted sources and other business contacts; investor conferences and symposia; and summits where companies pitch directly to investor groups in face-to-face meetings, including a variant known as "Speed Venturing", which is akin to speed-dating for capital, where the investor decides within 10 minutes whether s/he wants a follow-up meeting.

Слайд 14

Offering and first informal agreements

Offering. The company provides

the investment firm a confidential business plan to secure initial interest

Private

placement memorandum. A PPM/prospectus is generally not used in the Silicon Valley modelNegotiation of terms. Non-binding term sheets, letters of intent, and the like are exchanged back and forth as negotiation documents. Once the parties agree on terms they sign the term sheet as an expression of commitment.

Signed term sheet. These are usually non-binding and commit the parties only to good faith attempts to complete the transaction on specified terms, but may also contain some procedural promises of limited (30-60 day) duration like confidentiality, exclusivity on the part of the company (i.e. the company will not seek funding from other sources), and stand-still provisions (e.g. the company will not undertake any major business changes or enter agreements that

would make the transaction infeasible).

Слайд 15

Formal things

Definitive transaction documents. A drawn-out (usually 2–4

weeks) process of negotiating and drafting a series of

contracts and other legal papers used to implement the transaction. In theory, these simply follow the terms of the term sheet. In practice they contain many important details that are beyond the scope of the major deal terms.Definitive documents, the legal papers that document the final transaction. Generally includes:

Stock purchase agreements — the primary contract by which investors exchange money for newly minted shares of preferred stock

Buy-sell agreements, co-sale agreements, right of first refusal, etc. — agreements by which company founders and other owners of common stockagree to limit their individual ability to sell their shares in favor of the new investors

Слайд 16

More formal things

Investor rights agreements — covenants the

company makes to the new investors, generally include promises

with respect to board seats, negative covenants not to obtain additional financing, sell the company, or make other specified business and financial decisions without the investors' approval, and positive covenants such as inspection rights and promises to provide ongoing financial disclosuresAmended and restated articles of incorporation — formalize issues like authorization and classes of shares and certain investor protections

Слайд 17

Next stages

Due diligence. Simultaneously with negotiating the definitive

agreements, the investors examine the financial statements and books and records of the

company, and all aspects of its operations. They may require that certain matters be corrected before agreeing to the transaction, e.g. new employment contracts or stock vesting schedules for key executives. At the end of the process the company offers representations and warranties to the investors concerning the accuracy and sufficiency of the company's disclosures, as well as the existence of certain conditions (subject to enumerated exceptions), as part of the stock purchase agreement.Final agreement occurs when the parties execute all of the transaction documents. This is generally when the funding is announced and the deal considered complete, although there are often rumors and leaks.