Слайд 2

Module logistics

See the module outline for details.

Some highlights:

Textbooks:

Lipczynski, Wilson and Goddard

Church

Assessment: 1.5 hour exam (70%), and

an individual coursework (30%)

The seminar will take place during teaching weeks 9 and 10 (depending on your group).

Слайд 3

Module structure

Structure

? Conduct ? Performance

Market definition

Concentration measures

Concentration determinants

Testing

SCP, NEIO

Advertising

R&D

Market power & welfare

Product Differentiation

Слайд 4

IO is the application of microeconomic theory to

the analysis of firms, markets and industries

In IO

(unlike microeconomics), the industry structure is entirely modelled and is dynamic.

Number and size distribution of firms

Barriers to entry

Product differentiation

Vertical integration and diversification

What is industrial organization?

Слайд 5

IO increases our understanding of problems faced by

firms:

Externally, how firms compete in the marketplace (Theory of

markets)

Firm as a black box and focus on how firms compete with each other.

Internally, organizing production within the firm (Theory of the firm)

Look inside the firm and explain things firm size, the boundaries of the firm, and incentives within the firm.

What is industrial organization?

Слайд 6

For policy makers:

Competition policy aims to prevent firms

from abusing market power. [Sherman Act 1890, China antitrust

law 2007]

How to measure market power and excess profit?

How competitive is a specific industry?

What types of firm behavior can make an industry less competitive?

What type of market structure is most conductive of innovation?

IO and policymaking

Слайд 7

2010: The EU commission accuses Google of promoting

its shopping service in internet search at the expense

of rival services

Google is accused of systematically favouring its own comparison shopping product in its general search results pages

http://europa.eu/rapid/press-release_IP-15-4780_en.htm

Google’s response:

“Economic data (…), and statements from complainants all confirm that product search is robustly competitive”.

Google claims that Google shopping is operating in a field that includes Amazon and eBay, where shoppers go to compare prices.

IO and policymaking: The Google

antitrust case

Слайд 8

Google could face a 3bn euros fine.

Related to

that case, IO provides answers to the following questions.

How

to define a market?

How to measure market power?

How to stop dominant firms from abusing market power?

IO and policymaking: The Google

antitrust case

Слайд 9

Typology of market structures

Слайд 10

Dynamic theory where markets are changing due to

the activities of entrepreneurial and profit-seeking innovators.

“Creative destruction” (Schumpeter,

1928): Competition is driven by innovation

Innovation destroys old products and processes and replaces them with new ones.

Innovators earn profits and imitation gradually erodes these profits by cutting prices and raising input costs.

Abnormal profits and market power are necessary to motivate firms to innovate, and improve products in the long run

Austrian School: Schumpeter

Слайд 11

Creative destruction:

The music industry

1850

1900

1950

2000

Wind-up gramophone

Barrel organ

Pianola

Hi-Fi stereo

LP

records

Tape cassette

MP3

Compact Discs

Electrical gramophone

Слайд 12

The Chicago School

The Chicago School (1970-80s): Also argues

against government intervention

Large firms are large because they are

more efficient

In the long run abuse of market power is unlikely, e.g. collusive agreements are unstable

Markets have a tendency to revert towards competition, without the need for government intervention

Слайд 13

Concentrates on empirical analysis rather than on theoretical

analysis.

Bain (1956): There is a causal relationship between concentration

and profitability:

The SCP paradigm

Слайд 14

Structure ? Conduct ? Performance

The SCP paradigm

The

number and size distribution of firms

Entry conditions

Vertical integration and

diversification

Pricing strategies

Advertising

R&D

Differentiation

Collusion

Mergers

Profitability

Growth

Quality of products

Technical progress

Productive efficiency

SCP assumes a causal relationship between structure, conduct, and performance.

Most influential during the 1950-1970s.

Слайд 15

According to SCP, relationships between structural variables and

market performance hold across industries.

The line of causality

is from structure through performance. If a stable relationship is established between structure and market power, it is assumed that structure determines market power.

The SCP paradigm

Слайд 16

SCP & European banking: Structure

1980s: European banking was

fragmented. Banks did not operate in other countries [high

entry barriers]. Domestic banks did not face competition from foreign banks.

Deregulation made EU banking more competitive

Second Banking Directive, 1990

Creation of the euro

As a consequence: Banks able to trade throughout Europe.

Lowered entry barriers.

Do this make the industry more competitive or less competitive?

Слайд 17

SCP & European banking: Structure

1990-2009: decline in the

number of banks

Слайд 18

SCP & European banking: Structure

1990-2009: increased level of

seller concentration

Слайд 19

SCP & European banking: Conduct

Following the deregulation, many

banks have consolidated (M&A), e.g.

Unicredito (Italy) and HVB (Germany)

BNP

Paribas (France) Banco Nazionale de Lavoro (Italy)

Banco Santander (Spain) and Alliance of Leicester (UK)

Large banks have adapted their structures, risk management and strategic planning functions to deal with pan-European activity.

Слайд 20

SCP & European banking: Performance

1990-2006: increased profitability despite

the lowering of entry barriers.

How to explain the increased

profits?

Increased consolidation; Product diversification; Cost-cutting

Слайд 21

Structure ? Conduct ? Performance

Conduct

to structure? R&D, advertising, differentiation

Performance to structure? Growth and

changing market shares

Performance to conduct? Profitability and capacity to invest in R&D, or cut prices

SCP: Reverse causality?

Слайд 22

Structure ? Conduct ? Performance

Public

policies that aim to prevent the abuse of market

power

Preventing mergers beyond a certain scale [STRUCTURE]

Price controls, restrictions on collusion [CONDUCT]

Policies that also affect firms’ PERFORMANCE

Competition policy and SCP

Not allowing M&As

Taxation

Price controls

Слайд 23

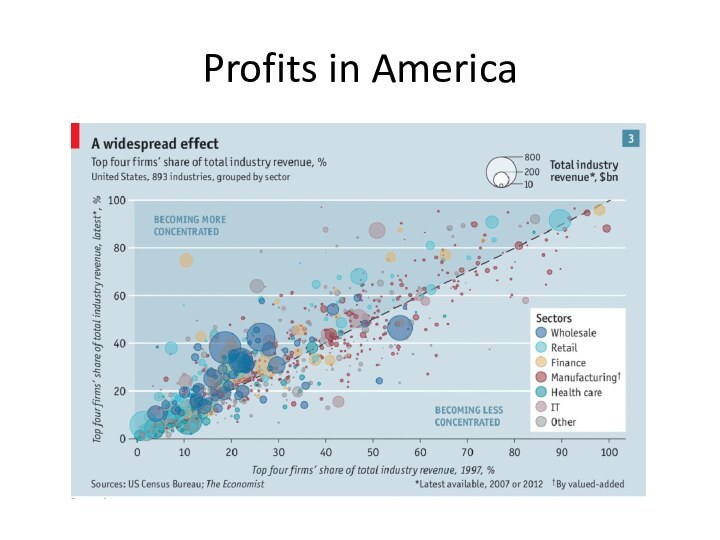

Profits in America and the

practical relevance of

IO

Source: ‘Too much of a good thing’. The Economist,

2016.

Profits have risen in most rich countries over the past ten years.

E.g. America Airlines: Used to make losses; but made $24bn profit in 2015.

How? The falling price of fuel has not been passed on to the consumers.

Why not? Consolidations has left the industry with 4 dominant firms with many shareholders in common.

Слайд 25

Profits in America

- Historical developments

In the 1990s American

firms faced a wave of competition from low-cost competitors

abroad.

In 1998, Joel Klein (DoJ), declared that “our economy is more competitive today than it has been in a long, long time.”

How to explain the recent increase in corporate earnings?

Since 2008 American firms have engaged in mergers worth $10 trillion, allowing the merged companies to increase market shares and cut costs.

Two-thirds of the industry sectors became more concentrated between 1997 and 2012. The average share of the top 4 firms has risen from 26% to 32%.

Слайд 28

Profits in America

About 25% of America’s abnormal profits

are spread across a wide range of sectors.

Another 25%

comes from the health-care industry (pharmaceutical and medical-equipment). Patent rules allow temporary monopolies on new drugs and inventions. Much of health-care purchasing is controlled by insurance firms. Four of the largest, Anthem, Cigna, Aetna and Humana, are planning to merge into two larger firms.

The remaining 50% abnormal profits are in the technology sector, where firms such as Google and Facebook enjoy market shares of 40% or more.

Слайд 33

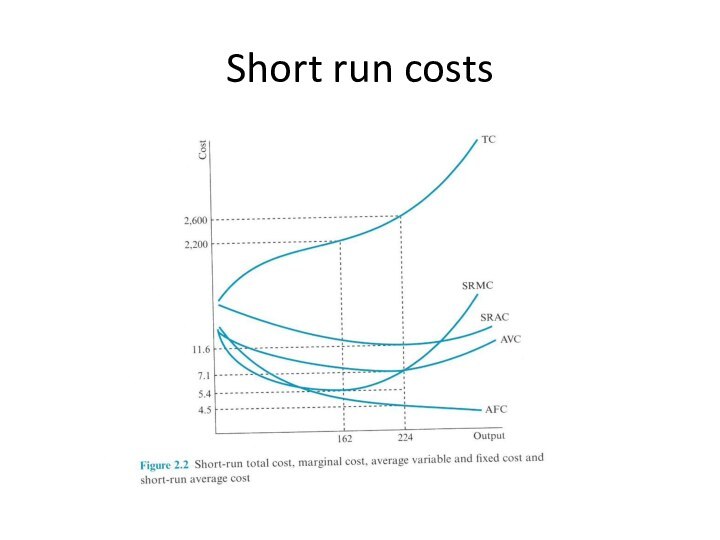

Long run costs

In the long-run, firms can change

their usage of all the inputs, including capital, number

and size of factories etc.

LRAC: Lowest cost of producing any given output level when the firm can vary both K and L.

Draw SRAC for all possible levels of K. The curve that enfolds these curves from below is the LRAC.

Compared to SRAC, LRAC decline longer before finally increasing

LRMC: long-run marginal cost

Слайд 35

Application to oil pipelines

Costs associated with construction and

operation:

Planning and design

Acquisition of clearing the right-of-way

Construction costs

Steel for

the pipeline

Pumps (One time fixed costs)

Electricity to power the pumps (variable costs)

Labor (monitoring personnel) (fixed cost)

Слайд 36

Application to oil pipelines

Electricity costs vary with throughput,

but the number of personnel does not.

The salary of

personnel is avoidable if the pipeline shuts down.

What are the variable costs?

What are the fixed costs?

Слайд 37

Economies of scale

Economies of scale impact the LRAC

Minimum

efficient scale = output level beyond which firms can

make no further savings in LRAC through further expansion.

Economies of scale

Indivisibilities

Learning economies

Purchasing economies

Transports economies

Diseconomies of scale

Long chains of command

Strained communications

Bureaucracy

Слайд 39

Empirical studies of economies of scale

Some firms have

U-shaped LRAC

However, manufacturing firms often have L-shaped LRAC

Estimates of

MES:

Слайд 40

Empirical studies of economies of scale

Survivorship studies: If

a particular plant size is efficient, eventually all plants

in that industry should approach that size.

Example from the beer industry:

Слайд 41

Economies of scope

Economies of scope are the cost

savings that arise when a firm produces two or

more outputs using the same set of resources.

Example 1: Manufacturing process

Oil refineries produce gasoline and kerosene as part of the refining process

Example 2: Knowledge gained from developing, producing, or marketing one product can be applied to another product

R&D investment for a specific software can benefit other categories of softwares

Слайд 42

Economies of scope

Example 3: Umbrella advertising

Advertising one Samsung

product will lead to more demand for other Samsung

products (even if they are not related).

New products are easier to introduce when there is an established brand with the desired image.

Virgin: 400+ companies, active in railways, airlines, soda, mobile, media etc.

Слайд 47

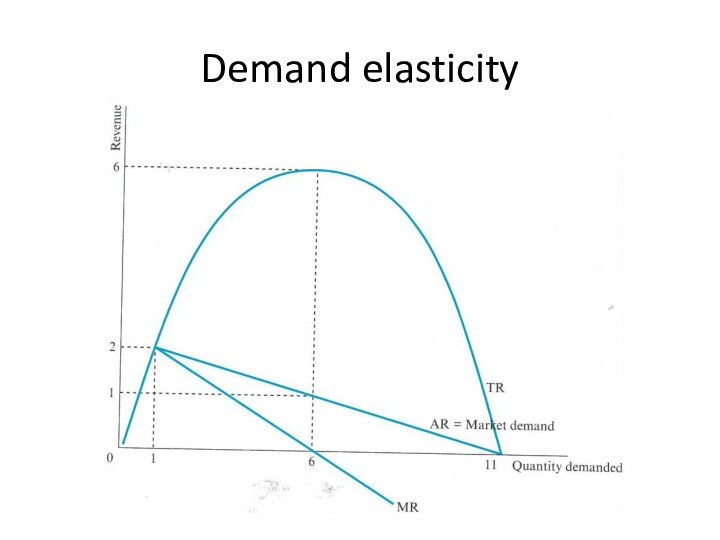

Cross-price elasticity of demand

CES>0. Goods 1 and 2

are substitute. As the price of Good 2 increases,

consumers switch from Good 2 to Good 1.

CES<0. Goods 1 and 2 are complement. As the price of Good 2 increases, demand for Good 1 decreases.

CED=0. Goods 1 and 2 are independent.