Слайд 2

Why Study Money, Banking, and Financial Markets

To examine

how financial markets

such as bond, stock and foreign

exchange markets work

To examine how financial institutions such as banks and insurance

companies work

To examine the role of money in

the economy

Слайд 3

Main Topics

What is money?

Who controls the money supply?

Why is money important?

Why is inflation a problem?

How do

banks make “money” (profits)?

Why are banks important?

How does the government regulate banks and why?

Financial Markets and financial instruments

What is monetary policy?

How does the Fed conduct monetary policy?

How are interest rates determined?

Слайд 4

Money

Money is the stock of items widely used

to make payment for goods and services.

Money, or

the money supply, includes:

currency and coins in circulation,

checking accounts in depository institutions, and

other items, such as Certificates of Deposit (CDs), when measured more broadly.

Слайд 6

What Determines The Money Supply?

The central bank

is responsible for the trend or long-run behavior of

the money supply.

Banks and non-bank public also play important roles in determining the aggregate money supply.

In the United States, the central bank is the Federal Reserve System (the Fed).

The Fed conducts monetary policy.

Monetary Policy refers to the management of money supply and interest rates.

Слайд 7

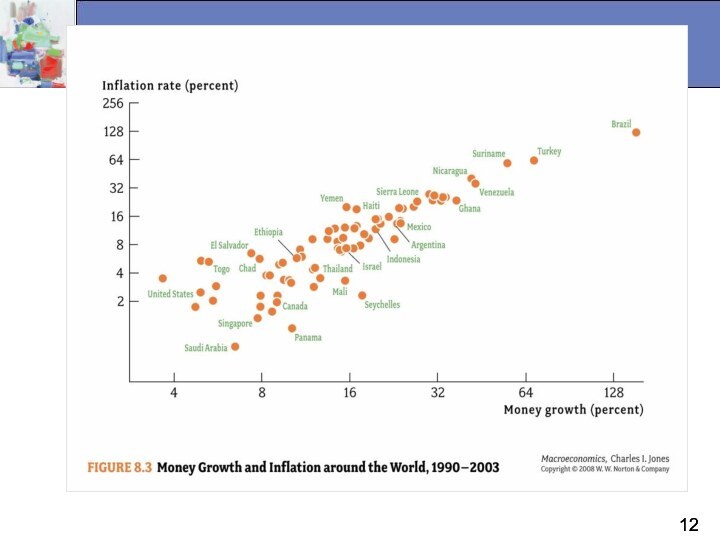

Money, Inflation, and Deflation

When the money supply

increases more rapidly than the output of goods and

services, inflation occurs.

Why is Inflation a problem?

Deflation is a continuing decline in prices and is more damaging to a nation's economic health than inflation.

Why is deflation a problem?

Inflation targeting occurs when a central bank announces an explicit inflation range it pledges to maintain and enforces policies consistent with that goal.

Слайд 8

Money and Business Cycles

Evidence suggests that money

plays

an important role in generating

business cycles

Recessions (unemployment) and

booms (inflation) affect all of us

Monetary Theory ties changes in the money supply to changes in aggregate economic activity and the price level

Слайд 13

Key Financial Markets

The stock market

The bond market

The foreign exchange (ForEx) market

Markets in which funds

are transferred from people who have an excess of available funds to people who have a shortage of funds

Слайд 14

The Bond Market and Interest Rates

A security (financial

instrument) is a claim on the issuer’s future income

or assets

A bond is a debt security that promises to make payments periodically for a specified period of time

Bondholders are lenders; stockholders are owners.

An interest rate (or yield) is the cost of borrowing or the price paid for the rental of funds and are determined by market forces of supply and demand.

Слайд 15

Facts about interest rates

There are many different interest

rates.

Interest rates tend to move together.

Sometimes we ignore the

differences among interest rates and focus on the interest rate level.

The interest rate level is determined in the bond market or loanable funds market.

There are intimate relationships among different interest rates.

Слайд 17

The Stock Market

Common stock represents a share of

ownership in a corporation

A share of stock is a

claim on the earnings and assets of the corporation

A company’s stock share price reflects the opinion of the market about the company's economic value, which ultimately depends on its future profitability.

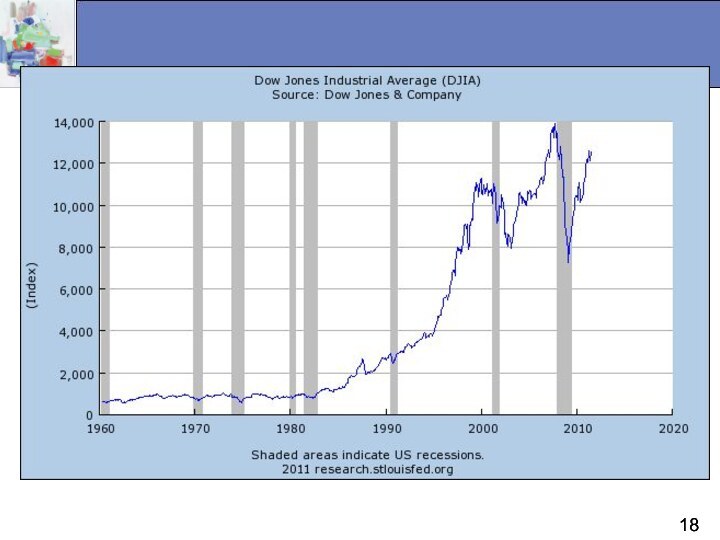

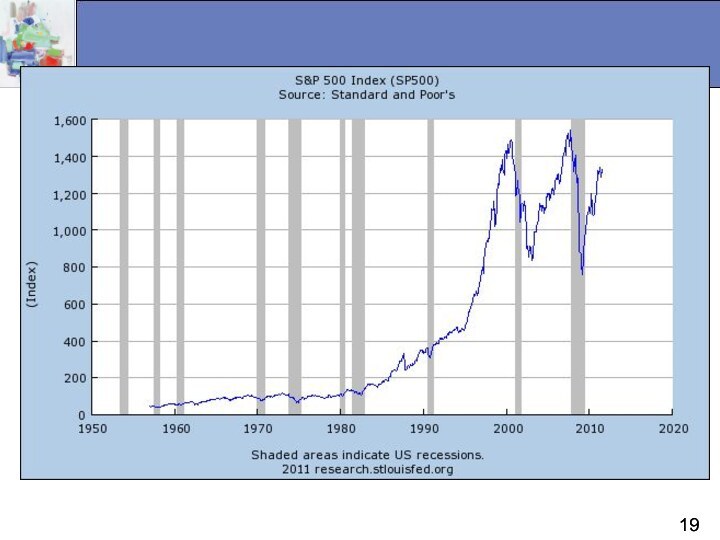

Major indexes reflect changing sentiment about the nation's economic prospects.

Dow-Jones Industrials Average (DJIA)

Standard and Poor's 500 Average (S&P 500)

Слайд 20

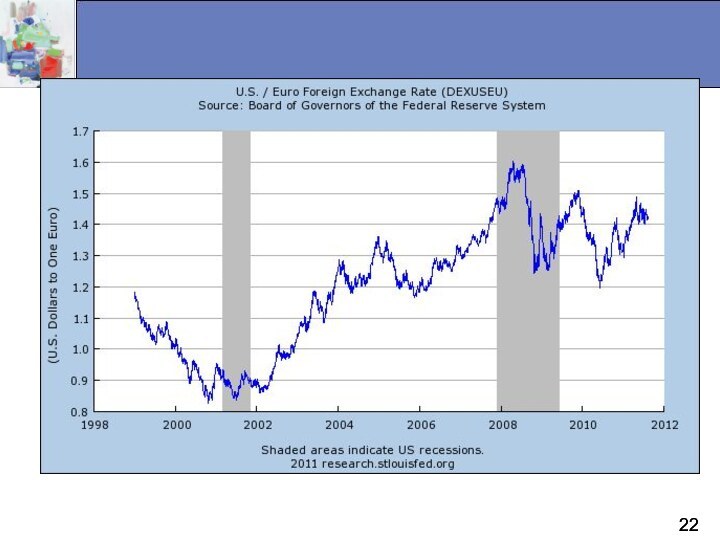

The Foreign Exchange Market

The foreign exchange market is

where funds are converted from one currency into another

The

foreign exchange rate is the

price of one currency in terms of

another currency

The foreign exchange market determines the foreign exchange rate

Слайд 21

Foreign Exchange and Trade

Appreciation is an increase in

the value of one nation’s currency relative to another

nation’s currency.

Depreciation is the opposite.

Appreciation causes:

higher prices to foreign buyers of exports,

lower prices to domestic consumers of imports, and

a trade deficit (or a reduction in the trade surplus).

Depreciation causes:

lower prices to foreign buyers of exports,

higher prices to domestic consumers of imports, and

a trade surplus (or a reduction in the trade deficit.)

Слайд 23

Banking and Financial Institutions

Financial Intermediaries—institutions that borrow funds

from people who have saved and make loans to

other people

Banks—institutions that accept deposits and make loans

Other Financial Institutions—insurance companies, finance companies, pension funds, mutual funds and investment banks

Financial Innovation—in particular, the advent of the information age and e-finance

Слайд 24

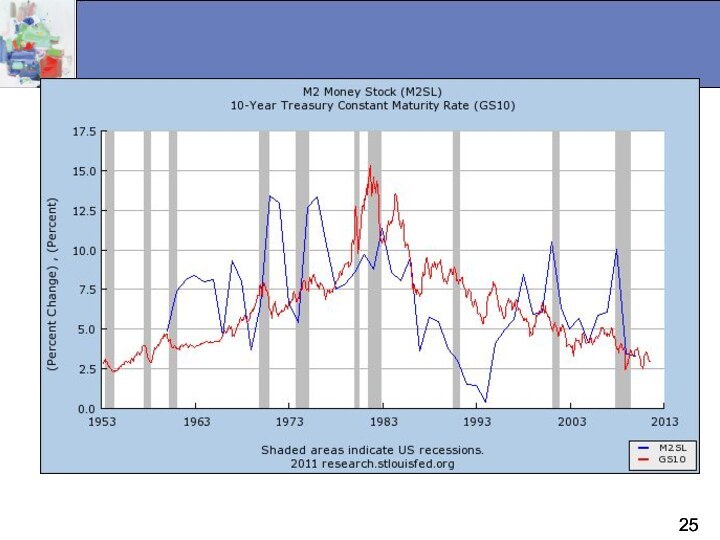

Money and Interest Rates

Interest rates are the price

of money

Prior to 1980, the rate of money growth

and the interest rate on long-term Treasure bonds were closely tied

Since then, the relationship is less clear but still an important determinant of interest rates

Слайд 26

Monetary and Fiscal Policy

Monetary policy is the management

of the money supply and interest rates

Conducted in the

U.S. by the Federal Reserve Bank (Fed)

Fiscal policy is government spending

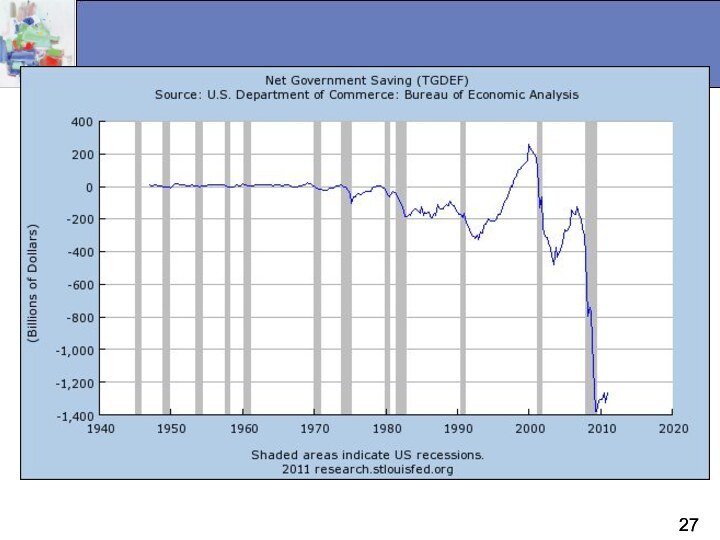

and taxation

Budget deficit is the excess of expenditures over revenues for a particular year

Budget surplus is the excess of revenues over expenditures for a particular year

Any deficit must be financed by borrowing