Слайд 2

Outline

The causes of global economic crisis

Channels of transmission

The

impact of crisis on global trade

Global crisis and trade

credit

Rising protectionism

Outlook

Role of trade policy

Слайд 3

Global Economic Crisis

In order to assess the role

that can be played by trade policy one has

to understand the causes of the crisis

Causes: Common elements: high credit growth, asset price appreciation (house price boom) large capital flows. New elements: increased financial integration, greater financial complexity, weakness in regulation and supervision

Channels: Financial and trade linkages

Слайд 4

Channels of transmission

Financial: As the crisis emerged in

the US subprime, it spread to other US financial

markets

International transmission: liquidity; banks with exposure to US, freezing of credits markets

Solvency: financial meltdown

Trade not a channel for contagion of the crisis, but casualty.

Слайд 5

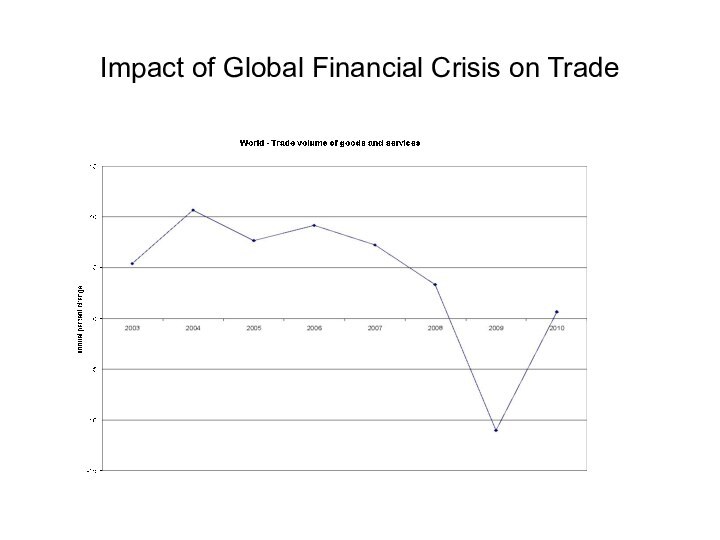

Impact on trade

Although the current crisis is a

financial crisis and is transmitted through the financial channel

internationally, it has an impact on both the supply-side and demand-side of trade.

Supply-side impact: Trade has collapsed due to drying up of trade finance; collapse of vertical integration; disruption in international capital markets

Demand-side: collapse of demand in advanced economies has a significant impact on emerging market economy exports

Слайд 6

Impact on trade

Until mid-2008, slowing of OECD demand

offset by strong growth in exports of capital- and

high-tech products

Capital good producing economies: Japan, Germany, Taiwan, China and US-most affected by collapse of investment

GDP collapse in Japan 12.1 %, 21% in Korea and 25% in Taiwan and China

Слайд 7

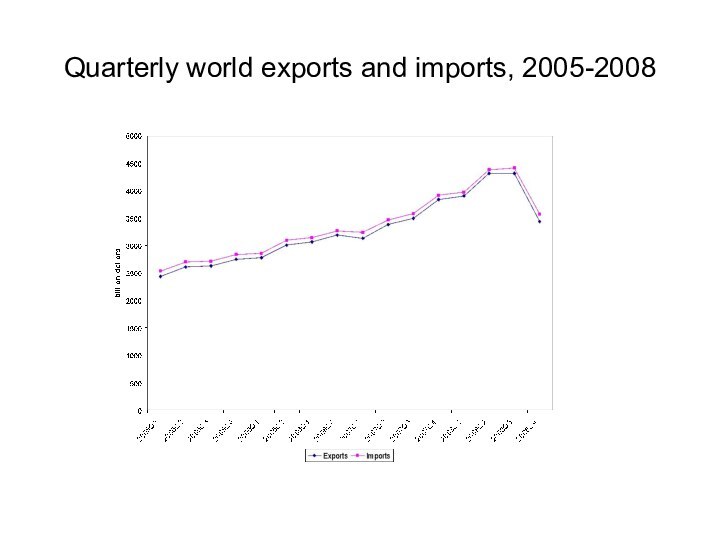

Quarterly world exports and imports, 2005-2008

Слайд 8

Impact of Global Financial Crisis on Trade

Слайд 9

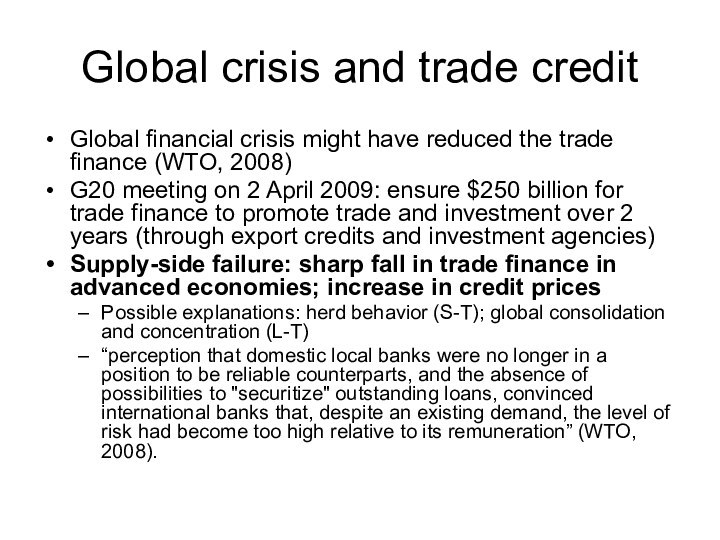

Global crisis and trade credit

Global financial crisis might

have reduced the trade finance (WTO, 2008)

G20 meeting on

2 April 2009: ensure $250 billion for trade finance to promote trade and investment over 2 years (through export credits and investment agencies)

Supply-side failure: sharp fall in trade finance in advanced economies; increase in credit prices

Possible explanations: herd behavior (S-T); global consolidation and concentration (L-T)

“perception that domestic local banks were no longer in a position to be reliable counterparts, and the absence of possibilities to "securitize" outstanding loans, convinced international banks that, despite an existing demand, the level of risk had become too high relative to its remuneration” (WTO, 2008).

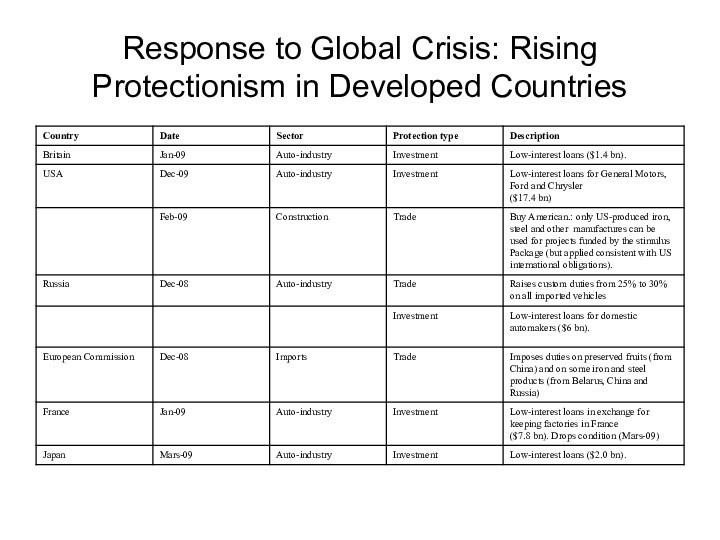

Слайд 10

Response to Global Crisis: Rising Protectionism in Developed

Countries

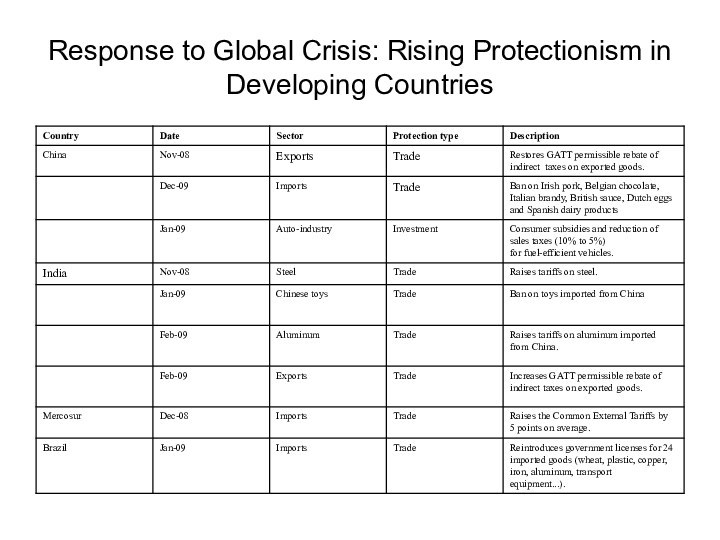

Слайд 11

Response to Global Crisis: Rising Protectionism in Developing

Countries

Слайд 12

Road to Recovery

Emerging markets economies are key to

global recovery

Decoupling theory: A survey of the decoupling debate

(Kose, et al 2008) reveals that during the last period of globalization (1985-2005) there has been convergence of business cycles fluctuations among the group of industrial and emerging markets. While these groups have become more integrated within themselves they have become more disconnected from each other.

As in the case of the current crisis the emerging markets were not initially affected (except Eastern Europe that is highly exposed to the financial crisis through its mainly foreign owned banking system). In this case, the transmission of the crisis from advance economies to the emerging markets through trade linkages were caused by the collapse of demand in advanced countries.

Слайд 13

Road to Recovery

The idea that EMEs are decoupling

vis-à-vis advanced economies has been quite widespread until the

onset of the crisis; however, more recent developments have discredited this view.

Despite the improvement in the fundamentals of many EMEs (after the 1990s crises) and the decline in their vulnerability, it seems clear that EMEs are suffering the consequences of the crisis.

The World Economic Outlook and the Global Financial Stability Report have highlighted important heterogeneity among the group of EMEs but the increase in the risk aversion (and uncertainty) has hit all of them.

Слайд 14

Road to Recovery

Given the weight of these emerging

market economies in world output and trade, they have

a significant role to play in terms of recovery.

Although emerging economies and developing countries as a group are expected to experience sharp decline in GDP, they will still have positive growth rates unlike advanced economies, except the NIA (Hong Kong, Singapore, Korea and Taiwan).

Слайд 15

Road to Recovery

According to IMF estimates Developing Asia

is the only region that is expected to have

strong growth (4.8%) in 2009.

Developing Asia: China (6.5% in 2009, 10.2% in 2011) India (4.5% in 2009, 6.9% in 2011).

Claessens et al 2009: A recovery without credit-

Financial downturns tend to last longer than economic recessions

Episodes of credit crunches and equity price busts last twice as long as recessions and house price busts last more than 3 times as long

For recessions with credit crunches, real economy picks up while credit is still contracting.

Слайд 16

Conclusion

If the theory of creditless recovery holds: it

is mainly going to be driven by consumption.

Given by

the increasing weight of emerging market economies, they will be the key players in recovery: as consumption is restored in these economies, demand will be restored

As exports are a significant driver of growth in these economies and in some cases more than 40% of the value added of exports are imported:

Protectionism is the wrong approach to recovery. It is only a short-term solution.